This store requires javascript to be enabled for some features to work correctly.

Below are answers to the most common questions we are asked. Please contact us if you don't see the answer to your question. We are happy to clarify or answer any questions you may have about selling or trading your jewelry. We are available 9am-5pm EST M-F (except holidays).

We guarantee you a minimum of 80% of the market value for your gold coins or jewelry. This is higher than what many gold buyers outside of New York typically offer. Our process is transparent: the refiner takes about 4-5%, and we retain 10-15%, ensuring you get a fair and competitive price.

We can provide a copy of the refiner's statement for each lot upon request.

It's also important to note that gold marked as 14kt or 18kt in the United States is often slightly lower in purity than advertised. For instance, 14kt gold may actually be 13 to 13.5kt, and 18kt gold may be slightly under 18kt. However, gold stamped 585 (for 14kt) and 750 (for 18kt) is usually plumb or accurately marked.

We evaluate in terms of craftsmanship, aesthetic value, history, brand name, desirability and more. Our trained jewelers have years of experience, can help you understand the value of your items, and answer all of your questions. We specialize in the authentication and valuation of all designer brands. From our experience, items bringing higher prices are exceptionally beautiful and well crafted pieces.

No. There is no obligation or pressure to sell / trade your jewelry, loose diamonds or gemstones. We will discuss and write down an offer for your consideration. Should you accept, you will receive payment immediately.

Payments are processed immediately on the day you accept the final purchase price for your jewelry. You can choose payment by check, ACH, or receive credit towards your next jewelry purchase from Fabon5th.com.

Demand for designer fine jewelry is great. We're always looking for branded and signed pieces from BVGARI, CARTIER, LOUIS VUITTON, TIFFANY & CO., CHANEL, VAN CLEEF & ARPELS, DAVID WEBB, BUCCELLATI, CHOPARD, DAVID YURMAN, HERMES, DIROR, FABERGE, PIAGET, MAUBOUSSIN and many others not listed here.

1. Do a little research online to find an Estate Diamond and Jewelry Buyer with a great reputation and positive reviews. You can normally tell which reviews are fake and those that are real. Go beyond the first page of results if you are doing an online search.

2. Visit more than one location to find a buyer who can offer you both immediate payment and the opportunity to market it for you. The Diamond capital of the country is New York City, so do not only consider local buyers or retailers, but look for a New York City buyer who can give you an estimate of fair value online, and the opportunity for insured shipping.

3. The Diamond buyer for the company you pick should be trained by the Gemological Institute of America, and most importantly be involved in the diamond market everyday. The diamond market is continually changing and the only way to know how to maximize the value of a diamond is to know what is happening in the market.

Selling to a trusted diamond and jewelry buyer will ensure you receive a fair price for your jewelry and are 100% confident in your decision. Having a trained GIA appraiser evaluate your diamond ring will ensure you receive top dollar and the most value for your ring.

1. What you can get largely depends upon what you purchased. The size and characteristics of the diamond you purchased will determine the value. How much you paid, and the name of the company you bought it from is largely irrelevant.

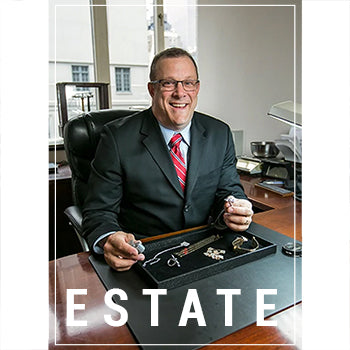

2. In general you can expect to get 20-45% of the original retail price. This is not a rule. When asked, Andrew Fabrikant, a leading estate diamond and jewelry in New York City buyer said, " I have been the highest bidder for a stone while only paying 10% of the retail cost. And I have paid multiple times what the diamond ring cost the original purchaser.

Andrew Fabrikant went on to say that what he likes most about the Estate Purchasing side of his business is that "I have never bought anything from the public without being the highest bidder. And never sold anything to the public for a price that is overvalued.

Yes, diamonds are an asset and if you own a diamond larger than 1 Carat you are often better off selling if it is not being worn. Diamonds are not good financial investments. Historically Diamond values go up on average about 1% per year. There are much more effective places to invest the money and receive much higher returns.

The same answer can be considered for selling jewelry that is not being worn. Unworn jewelry is an asset that is often not growing in value as fast as investing it wisely would provide. With gold as high as it is now is an opportune time to sell your broken, unworn jewelry and gold bullion. When you see multiple television shows dedicated to getting you to invest in gold coins, or bars it is likely a good time to sell.

Andrew Fabrikant one of the leading, and most reputable Diamond and Jewelry merchants in New York City. The name of his company is Andrew Fabrikant & Sons, and is your best and most reliable resource for selling your diamond rings, necklaces, bracelets and other jewelry.

1. There is no simple answer to this question. If you have a diamond that has been certified by the GIA (Gemological Institute of America) you can get a value estimate by sending a copy of the report to a reputable jewelry purchaser.

2. There are jewelers who will inflate the valuation they give until they see the diamond. Our suggestion would be to ask for a range of values based on the GIA report. If you do not have a GIA report which is a scientific examination of the properties of a diamond, a market expert should be able to give you a fair range based on an appraisal description or from a report from another laboratory.

3. If you want to know exactly what you are selling you can submit a diamond to the GIA on your own or a trusted jeweler can do it for you. Be aware that diamonds submitted to the GIA for grading have to be removed from the mounting they are in. The GIA is the only laboratory whose Diamond Grading Reports are accepted world wide. There are jewelry companies that will provide this service for you, or you can have a local jeweler remove the stone from the mounting for you, and then submit it directly.

While the most popular times of the year to purchase diamond engagement rings, are in the spring, and holiday seasons. Your timing when selling a diamond is less important. Diamond merchants are continually buying. The diamonds that bring the most money are because they have the largest demand.

The best way to find out its value is taking it and having it appraised by a expert. There are so many things that have to be taken into consideration when evaluating the value of a piece of jewelry, such as type of metal and the weight of metal to the type of gemstones and the quality of the stones.

YES. They will have professional tests that will determine whether your jewelry is real as well as the purity of the metal itself. A trained appraiser will be able to provide the value of the piece as well.

If you need or want to sell physical gold, you have options. Selling to a traditional bank is typically not one of them. Seek out a highly reputable precious metals dealer or reputable jeweler is the best option.

This depends upon where you sell it. Buyers outside of competitive markets like New York City often pay much less than jewelry buyers in competitive markets.

You can generally expect to get between 50% and 90% of the current gold price for your jewelry. If your jewelry is older or has historical significance, you may be able to get even more for it. the more gold you have the higher percentage you can usually receive. Gold coin or Bullion will often bring the highest percentage, up to 95% of its value.

Yes. First gold is very valuable. This means a significant chance of receiving more money by selling some of your old gold items. Secondly, getting cash for gold lets, you liquify your assets and have access to the money for investment or use.

Scales in the United States have 28 grams per ounce, but gold is usually measured with Troy ounces that contain 31.1 grams. Some dealers also use a system of weights called pennyweights (Dwt) to measure a Troy ounce. A pennyweight has 1.555 grams.

An appraisal helps ensure you got what you paid for.

This is up to your comfort level with the jeweler you entrust to appraise your jewelry and how many pieces you are having appraised. Large estates can have hundreds of pieces of jewelry in them and a proper appraisal can take time to complete. If you are looking for an appraisal of a recent purchase and it is only one or two items it should not be necessary to leave your jewelry with an appraiser.

If you are looking for resale value make sure your appraiser understands the purpose of what you are looking for. Often referred to as Estate or Fair Market Appraisals, these should be written with an understanding of the demand for the jewelry. Insurance appraisals are usually written 20% to 40% above what you could purchase the same item for at a retail store.

This depends on the complexity of the piece and level of difficulty in the identification of some gemstones, but for the most part, an appraisal can be finished within the time you have for your lunch break.

If you insure your jewelry an appraisal is the only way to document the value and description of your jewelry should anything ever happen to it.

We recommend taking the piece to a jeweler to be tested. They will have professional tests that will determine whether your jewelry is real as well as the purity of the metal itself. A certified appraiser will be able to provide the value of the piece as well.

Every two to three years. Insurance companies and appraisers recommend updating jewelry appraisals every two to three years.

Having your jewelry appraised will make sure the item is properly described and valued in order to receive an adequate insurance replacement in the event of damage, loss, or theft and can assist when buying or selling an item

Selling to jewelry stores is often better than pawn shops. Pawn shops have high overhead costs and typically resell items at a lower price. For higher end or inherited jewelry you should find a professional jeweler who specializes in purchasing jewelry. They have proper outlets for all types of jewelry and will be have a better understanding of the entire jewelry market place.

Not on your own. If a buyer is purchasing the jewelry for only the gold weight then they should remove the stones and give them to you if you believe they have value. Your best bet is to show the jewelry to a jeweler who specializes in buying jewelry. They would always prefer to purchase a finished piece of jewelry, and can always remove stones with your permission. Loose gemstones are likely worth less than when not included in a finished piece of jewelry, so be careful of a buyer only purchasing the item for its metal content.

Gemstones can best be sold at jewelers, goldsmiths, gemstone dealers or even auction houses, this depends greatly on the type of gemstone and its quality. Who can appraise stones? Gemstone and jewelry appraisers can estimate the resale value of a gemstone.

If your jewelry will never be worn or the money you can get would be useful then selling it is logical.

If you are looking to purchase a piece of jewelry and you would like to use your unworn jewelry as payment you have the benefit of not having to put it on a credit card or paying for it from savings. However, it can make the transaction less transparent. You might want to ask the jeweler how much they might give you for your jewelry before you tell them what jewelry item you would like to purchase.

In situations where the deceased person did not leave a will or trust or it does not specify how particular pieces of jewelry should be distributed, it is essential to split it fairly among heirs The only way to do this fairly is to research and find the best jewelry purchaser and sell the jewelry. Money can be divided equally, jewelry is much more difficult to divide amongst siblings without causing resentment.

At Andrew Fabrikant & Sons we can arrange your valuation for you. Our experts examine your jewelry and provide a written valuation that acts a legal document you can use for insurance. We'll take digital photographs, note any distinguishing features and write a full description of each item. If you want to know if you are offered a fair deal for a diamond and ring you are considering purchasing, Andrew Fabrikant & Sons / Fabon5th.com will give their advice for free. By sending them all of the information about the diamond and ring they can assess the price being offered to you and advise you if it is a fair deal or not.

Our GIA-certified jewelers will inspect your items in person and generate a final purchase price for your jewelry. We will provide you with an offer within 1 - 3 business days. (Usually the same or the next day, but we prefer to under promise and over deliver). If our offer does not appeal to you, we will ship your items back to you immediately if we cannot offer a good alternative. We will ship your items back to you at our expense.

The process is simple and easy, as outlined below.

• Tell us about your diamonds, jewelry, and watches. You can contact us and follow up with photos by email or text message.

• After reviewing your photos and description of items, we will respond with an offer-price range we think is appropriate for your jewelry.

• If you like the offer, you can send your items for a final inspection. Shipping is secure and insured. There is no obligation.

• We will generate an offer price after inspection. Upon acceptance of the offer, you will receive immediate payment by check, ACH, or bank transfer.

Receive a quote. We will review your submission and provide an estimated offer within 1 - 2 business days. There is never any obligation to sell. Include any information you have about your items, including appraisals, laboratory reports, store receipts, insurance descriptions, and even family lore can help us help you—forward pictures of the front and back of each piece. For watches, please include a view of the side of the watch with the crown.

Our mail-in service is simple, safe, and fully insured. We will help establish insurance levels to protect you against loss and help you arrange for insured shipping. We will send you a shipping package for your jewelry. Our return shipping address will be on the label included. We will ship your jewelry back to you free of charge if you choose not to accept either option. While there are no fees for our services, any international shipping fees and customs duties for mail-in returns will not be refunded.

Include the following inside the package along with your jewelry.

• Contact information: Name, address, daytime phone number, email address.

• Inventory List: of items inside the package you are sending.

• Required Documents: Second Hand Trading Laws require us to have a copy of a government-issued form of identification. A copy of your passport, driver's license, military ID, or state ID.

• Proof of mailing address: ( Ie: A utility bill in your name)

• Other Items: Include original paperwork and boxes if possible. They can increase the value of both watches and jewelry. If your name or personal information appears on the paperwork, we will keep your information private.

Important Packing Instructions:

• Use protective packing materials to prevent movement or damage during transit (bubble wrap, air pads, packing peanuts, foam, etc.) Tapping the protected packaging to the bottom of the box should help prevent the piece from being damaged in the shipping process.

• Take the package to your nearest FedEx location or the US Postal Service Branch. We will help you get the jewelry to us safely.

• We will notify you upon arrival.

If your jewelry qualifies, we can offer you the opportunity to have Andrew Fabrikant & Sons and Fabon5th.com market the gems, jewelry, or watches for you. There is no commission you pay. The buyer is responsible for our compensation. Call for more information at 212-557-4888.